Navigating the New 15% Tariff on EU Imports: What Heavy Equipment Dealers Need to Know

The United States and European Union have struck a new trade framework imposing a 15% import tariff on most EU-origin goods. This broad tariff applies “across the board” to a wide range of products, affecting industries from agriculture and construction to material handling and heavy trucks. For dealerships handling European-made equipment, this development represents a significant shift that demands prompt action. Below, we break down the current situation, its impacts, and strategic recommendations – including key takeaways and action items tailored to dealership leadership roles (Dealer Principals, CFOs, Service Managers) – to help you navigate these changes confidently.

Disclaimer: The information in this article reflects the current understanding of an evolving situation as of now. Details may change as further updates emerge.

Current Situation and Known Impacts

Tariff Overview

A 15% import tariff on nearly all equipment imported from Europe is now in effect. This measure was introduced as part of a recent U.S.–EU agreement to rebalance trade and was set at 15% (half of an initially threatened 30% rate) to avert a larger trade conflict. Heavy equipment, machinery, vehicles, and most components from EU countries are subject to this tariff, with only a few categories (like aircraft or certain raw materials) exempt. In practice, this means almost any new European-made unit or part your dealership brings in will incur a 15% duty at U.S. customs.

Increased Equipment Costs

The most immediate impact is higher acquisition costs for European-sourced inventory. For example, a piece of equipment previously priced at $200,000 would now face an additional $30,000 in tariff fees at import. Even smaller items are affected – a $50,000 attachment or component now carries a $7,500 tariff. These added costs raise the baseline cost of goods sold dramatically, forcing dealers to either absorb the expense or pass it to customers. Margins that were tight to begin with will shrink if prices aren’t adjusted.

Varied Impact by Dealer Size

The financial hit will vary by dealership size and volume. A single-location dealer that imports, say, $2 million in equipment annually could see roughly $300,000 in extra tariff costs per year. In contrast, a multi-location dealership group importing $10 million of inventory might face $1.5 million or more in annual tariffs. Smaller dealers may find it harder to absorb or negotiate away these costs due to limited economies of scale, while larger groups, though paying more in absolute terms, might leverage their volume or diversify their sourcing to mitigate the impact. The scale of exposure will influence each dealer’s strategy – but no one is untouched.

Margin Pressures and Profitability

Whether large or small, dealerships will experience pressure on profit margins. If you choose not to raise prices immediately, the 15% increase on cost of goods sold directly eats into your gross margin. Dealers that typically operate on, for example, a 10% net profit margin could see that wiped out or turned into a loss on each European unit if they absorb the tariff cost. Even passing on the full cost may not be straightforward – higher customer prices can dampen demand. This balance between preserving margin and maintaining sales volume is now a central concern, especially for CFOs and financial teams doing forecasts.

Inventory and Supply Chain Adjustments

With European imports now more expensive, dealers may need to reconsider product mix and sourcing. It’s prudent to analyze your current inventory and incoming orders to understand tariff exposure. Identify which equipment or parts in stock (or on order) originate from Europe and quantify the cost increases. Dealers might look at ordering from domestic manufacturers or alternate international sources that aren’t subject to the tariff. In some cases, it may be worth accelerating orders already placed (to land before any cutoff dates, if applicable) or delaying/canceling orders for less critical items. Supply chain managers should also anticipate potential delays if European suppliers re-route or adjust to the new rules. Flexibility in your supply chain will be key – for instance, consider stocking up on high-turn or critical parts that are EU-sourced, as those will now cost more and could face supply hiccups in the near term.

Parts and Aftermarket Costs

This tariff doesn’t just hit whole goods – parts and components from Europe are also subject to 15% duties. Dealerships’ parts departments need to account for higher costs on OEM parts imported from European plants. Everything from specialized engine components to electronic parts will carry a premium. This could increase the cost of certain repairs and maintenance for your customers and potentially affect service pricing. Service and parts managers should review sourcing for parts: are there U.S. or non-EU aftermarket alternatives of acceptable quality? Can you optimize your parts inventory by purchasing critical European-made parts now (before price increases fully filter through) or by finding substitute suppliers? Being proactive here will help avoid either passing sudden cost hikes to customers or eroding your parts department margins.

Customer Demand Shifts

Be prepared for possible shifts in customer behavior as a result of these price changes. When equipment prices jump sharply, some customers may postpone new purchases or seek cheaper alternatives. Industry analysis is already indicating that more buyers could turn to used equipment to meet their needs, since used machines avoid the new import tariff and offer better value in the short term. This means your dealership’s used equipment inventory might see increased interest. However, it also means new equipment sales could slow, impacting your revenue projections. Keeping a close eye on sales trends and customer inquiries in the coming weeks will be important. If you notice hesitation among buyers, consider strategies like promoting good-quality used inventory, offering rental options, or creative financing deals to keep sales moving despite higher prices.

Strategic Recommendations for Dealers

To navigate these challenges, dealership leaders should take a strategic and proactive approach. Below are key recommendations and action items to implement immediately:

Immediate Financial Assessment: Conduct scenario-based financial planning right away. CFOs and finance teams should model several scenarios for how to handle the tariff costs – for example:

- Full pass-through (increasing customer prices by the full 15%)

- Partial pass-through (splitting the cost between higher prices and margin reduction)

- Absorption (dealership absorbs the tariff entirely, at least temporarily)

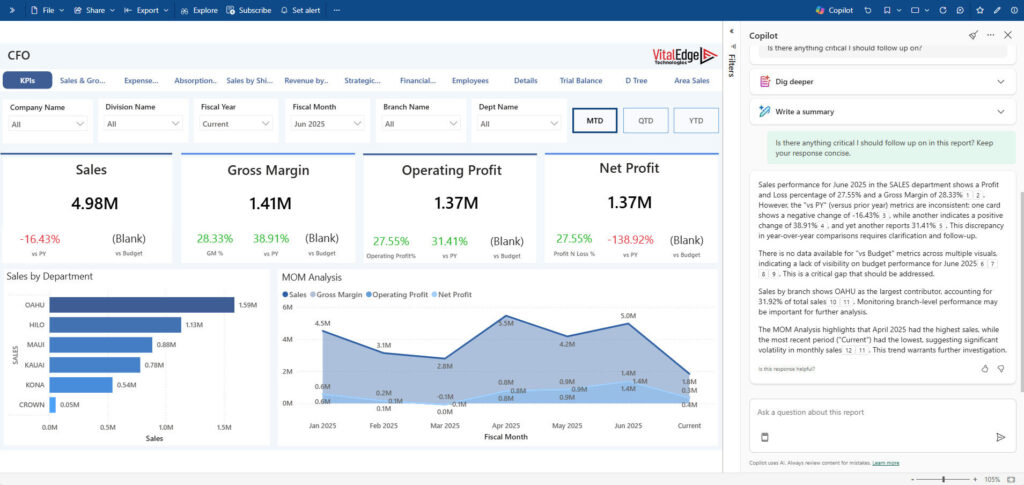

For each scenario, project the impact on your profit margins, cash flow, and balance sheet. This kind of what-if analysis will clarify how long your dealership can sustain each approach and what pricing strategy makes sense. Use your financial forecasting tools (like those integrated in modern dealer management systems) to run these models quickly. From this exercise, develop a contingency plan: e.g. “If we see unit sales drop by 20% due to higher prices, we will implement cost-cutting measures X and Y,” or “If we decide to absorb tariffs this quarter, we will require budget adjustments in other areas to maintain profitability.” Having clear plans prepared for multiple outcomes will enable you to react decisively as real data on sales and margins starts coming in.

Inventory Optimization and Diversification

Revisit your inventory strategy with an eye on tariff exposure. Start with an audit of current stock and on-order units: identify which items are affected by the tariff and quantify the added cost per item. Next, consider diversifying your product sources. Can you source comparable equipment models from domestic manufacturers or from countries not subject to the tariff? For example, if you are a construction equipment dealer heavily reliant on a European brand, you might explore carrying additional lines from U.S. or non-EU companies to offer customers tariff-free alternatives. Also evaluate your order pipeline: you may decide to prioritize incoming stock that is tariff-free, and slow down orders of European models until the financial picture is clearer. In addition, focus on inventory turns and mix – with higher carrying costs, it’s more important than ever to stock the right equipment that will move quickly. Leverage parts and inventory management software (such as VitalEdge’s integrated inventory module) to track sales trends and optimize reorder levels. Finally, maintain close communication with your supply chain partners; if certain European orders can be re-routed or consolidated to save on shipping and handling of tariffs, pursue those efficiencies. Some dealers might even partner with other dealers to bulk-import and share the tariff burden on large shipments, if that’s feasible through your networks.

Operational Efficiency and Technology Integration

In a tighter margin environment, improving operational efficiency is critical to offset increased costs. Dealerships should look internally for cost-saving opportunities and productivity gains. Start by conducting process audits in each department – sales, service, parts, rentals – to identify inefficiencies or waste. Even small improvements (streamlining a workflow, reducing overtime, cutting idle inventory, optimizing warranty claim processing) can add up across the organization. Leverage your Dealer Management System (DMS) and related technologies to assist in this effort. Modern integrated systems like those from VitalEdge can unify data across finance, sales, parts, and service, helping you pinpoint where expenses are high or processes slow. For instance, using an integrated DMS, you can automate routine tasks (reducing administrative labor costs), use data analytics to find patterns (like service jobs that consistently run over time/budget), and implement best practices that other dealers have used successfully. Investing time now in training staff on these tools and fully utilizing features you already have – such as automated inventory reorder points, service scheduling systems, or digital approval workflows – will increase your dealership’s agility. Additionally, consider technology that specifically targets cost reduction: for example, a financial planning module for more accurate budgeting, or a parts management system that optimizes stock levels to avoid tying up cash unnecessarily. Every efficiency gain you achieve internally acts as a counterbalance to the external cost pressure of tariffs.

Transparent Customer Communications:

Keep your customers informed and maintain trust through proactive communication. Dealer Principals and sales managers should craft a clear message explaining the situation to customers. It’s better that they hear about potential price increases or changes from you first – along with the reasons – rather than encountering sticker shock with no context. Be transparent that a government-imposed tariff has increased costs and assure them that you are taking measures to minimize the impact on them as much as possible. Equip your sales, parts, and service teams with consistent talking points so that everyone from the showroom to the field service truck can convey a unified message. Emphasize the value your dealership still provides, for example, your commitment to fair pricing, excellent service, and support through the equipment’s life. If you do need to adjust quotes or estimates upward due to the tariff, do so openly and honestly – perhaps even line-item the tariff in invoices or quotes, so customers see it’s an external cost being added, not an arbitrary price hike. In addition, consider offering creative solutions to loyal customers who are hesitant: this could include flexible financing options, longer-term leases, or bundling additional services (like extended maintenance plans) to soften the blow of higher prices. Showing a willingness to work with customers during this period will help preserve relationships and loyalty. Remember, the goal is to maintain customer trust and confidence that your dealership is navigating this challenge with them, not against them.

Engagement with OEMs and Industry Partners

Reach out to your OEMs, distributors, and industry networks to collaborate on solutions. Manufacturers of the equipment you sell are very much aware of these tariffs and will be formulating their own responses. Don’t passively wait – actively engage your OEM reps to find out what support might be available. This can include temporary rebates or discounts to help offset the tariff, extended floorplan terms or credit facilities to ease the cash flow burden of higher inventory costs, or joint customer incentives (for instance, the OEM funds a special discount or free add-ons to encourage sales despite price increases). In some cases, OEMs might be able to adjust their logistics (such as shipping machinery from a non-EU plant if they have one in another region), ask if such options exist for the product lines you carry. Also, stay in close contact with your industry associations (e.g. equipment dealer associations) and peer networks. They can be great sources of up-to-date information and creative strategies being used by other dealers. If certain models become less viable due to cost, perhaps other dealers have excess non-tariffed inventory you could arrange to swap or purchase, and vice versa – explore those partnerships. Additionally, use any OEM integration features in your systems (for example, direct ordering portals or inventory visibility tools provided through your DMS) to stay aligned with the manufacturer on inventory and parts. The situation with tariffs could evolve (for instance, political developments might change the rate or duration), so having a pipeline for the latest info from OEMs and industry groups will let you adapt quickly. The bottom line: don’t navigate this alone – leverage the broader ecosystem. Many stakeholders (OEMs, associations, even government trade offices) have a vested interest in seeing dealers get through this period without severe damage, and they may offer resources or influence to help your dealership succeed.

Throughout these strategic steps, maintaining agility and good data is key. Track the impact of the tariff on your sales and costs closely in the coming weeks and months. Treat your strategic plan as a living document – adjust your tactics as you gather real-world data on how customers and suppliers are responding.

Key Takeaways and Action Items for Dealerships

To summarize, here are the key takeaways and recommended action items, tailored to different roles in the dealership:

For Dealer Principals: Lead with a proactive strategy and clear communication.

Ensure your whole team understands the game plan for responding to the tariff. Reassess your business strategy and product portfolio – you might need to pivot focus to product lines or services that are less tariff-affected. Strengthen your relationships with OEMs and discuss support options; your engagement can influence what assistance or flexibility they provide. Also, oversee the customer communication strategy: make sure your sales and service teams are prepared to explain the situation to customers in a transparent, solution-oriented way. Finally, be the stabilizing force for your organization – in times of uncertainty, your employees will look to leadership for confidence. Share with your staff the steps the company is taking and foster a mindset that challenges can be overcome with smart planning and teamwork.

For CFOs and Financial Managers: Focus on financial resilience and planning.

Immediately dive into the numbers – perform the scenario analyses mentioned above to understand best-case, worst-case, and likely-case outcomes for your financials. Review your pricing strategy: decide how much of the tariff cost can be passed on without stalling sales, and at what point absorbing cost threatens viability. Also, revisit your budget and cash flow projections – higher inventory costs might mean you need to increase working capital or floorplan credit lines; speak with your lenders early if you anticipate the need for credit adjustments. Leverage any financial forecasting tools or modules in your system to update projections. Keep a close eye on expenses across the dealership and identify areas to trim or postpone (e.g. can certain capital expenditures be delayed until you see how profits are affected?). This is also a good time to establish or bolster a financial contingency fund, if possible, to buffer against volatility in the coming year. In short, be ready to protect the dealership’s financial health by adjusting levers on both the revenue and cost side and continuously monitor the KPIs that matter (gross margin, net profit, cash on hand, debt covenants, etc.) considering the new tariff-induced pressures.

For Service and Parts Managers: Optimize operations and capitalize on after-sales opportunities.

With new equipment sales facing headwinds, the parts and service department becomes even more crucial in sustaining revenue. First, ensure you have a robust parts inventory strategy: identify critical European-sourced parts that might become costlier or scarcer; if they are essential for keeping customer machines running, consider stocking extra quantities now or finding alternate suppliers. Use your parts management systems to analyze usage rates and adjust reorder points so you’re not caught short on high-demand items. Secondly, focus on operational efficiency in the service bay – streamline workflows, reduce turnaround times, and eliminate waste. If your dealership has productivity tools (like scheduling software, mobile technician apps, or integrated service history in your DMS), make sure they are fully utilized to get more done with the same resources.

Additionally, be prepared to support customers who hold onto equipment longer due to higher new prices. This could mean ramping up marketing of maintenance packages, inspections, and rebuild services. Train your service advisors to remind customers of the importance of proper maintenance in times like these – it both helps the customer (maximizing uptime of older units) and drives service revenue for the dealership. Lastly, coordinate closely with the sales and finance teams on customer messaging; service managers can play a role in reassuring customers that, despite higher new equipment costs, the dealership can support them through excellent parts availability and service for their existing fleet. By excelling in after-sales service now, you not only generate income but also foster customer loyalty that will pay off when the market stabilizes.

VitalEdge remains dedicated to supporting and empowering dealerships through industry shifts like this. As your committed partner, we will continue providing timely updates, practical insights, and innovative tools to help you adapt and thrive. The new tariff landscape is challenging, but with careful planning, open communication, and strategic use of technology, your dealership can navigate these changes successfully and emerge stronger. We’re here to help you every step of the way – together, we can turn these headwinds into an opportunity to improve and excel in every facet of your dealership’s operations.